The words powerful, unique and game changing are ones that are often over used when applied to trading indicators, but for the NinjaTrader Quantum Camarilla levels indicator, they truly describe this new and exciting indicator completely.

Why? Because the indicator has something to offer every trader, from the systematic to the discretionary and from swing trading to breakout trading. And it’s not an indicator which is simply used for entries. The Camarilla indicator delivers in all areas, from getting in to getting out as well as stop loss placement. All in one single indicator which perhaps explains its unique appeal and power to those traders in the know. Now, it’s all here just waiting for you to discover the power of the Camarilla protocol and apply this unique indicator to your own trading and investing tactics.

So what is the Camarilla protocol, how does it work and what will it do for me? These are all good questions, so let’s get straight down to basics and explain how the indicator works and how you may wish to use it.

Let’s start with the last of these questions first, as this is one of the unique aspects to this indicator. Put simply it is a chameleon of an indicator, and will appeal whether you are a more discretionary type of trader, making and taking decisions yourself, or if you prefer a more systematic or mechanical approach often associated with an EA for example. With the Camarilla levels indicator both approaches can be embraced and accommodated.

The Camarilla protocol has its roots in the open outcry trading pits, where traders considered floor pivots an essential tool. Based on these original ideas and incorporating the Camarilla equation we have developed a unique indicator which delivers clear and precise price based support and resistance levels, which act as targets for profits, triggers for potential reversals, signals for possible breakouts, and finally stop loss placement. So, if you’re a swing or reversal trader, it’s the perfect indicator. Equally if you prefer breakout trading, again it’s the perfect indicator. And all with predetermined and clear levels for any price objectives and profit targets, with stop loss placement covered also.

In other words a complete indicator, and one which is delivered with potential trading setups built in to help you see when key levels are being approached or breached.

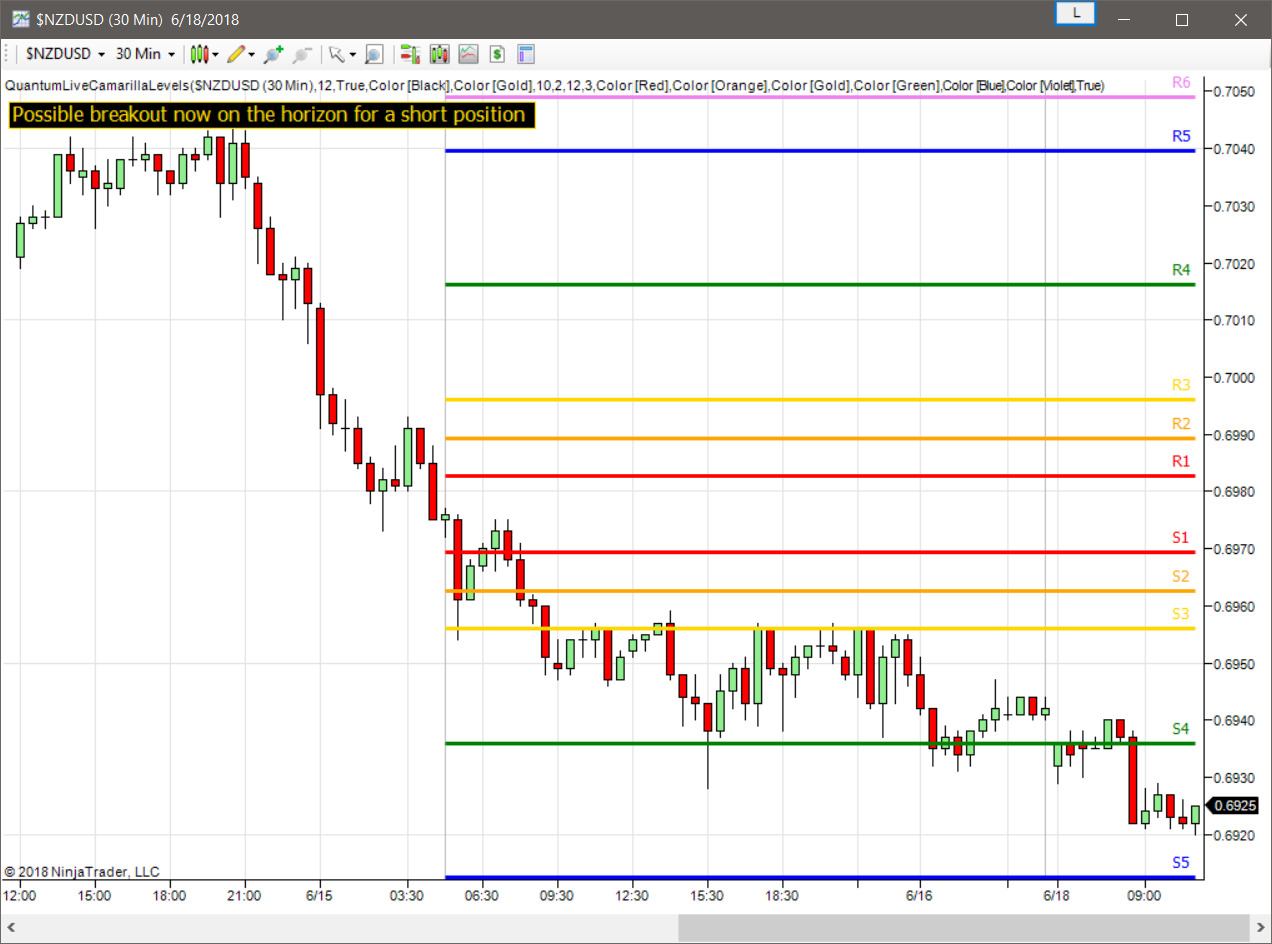

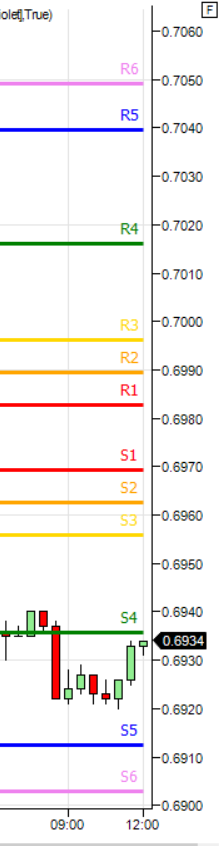

The indicator works in a complex way, but the data is presented simply using six levels above the price action and six levels below. Those above are labelled R1 to R6 and those below S1 to S6 with the region between R1 and S1 which we describe as the ‘buffer zone’. These levels are calculated for the different timeframes in different ways.

For daily timeframes and above the levels remain the same for the month, and they are then recalculated at the start of the new month. For intraday timeframes these are recalculated at the start of each new daily session.

Reversal Trading

For reversal trading the key levels to watch are S3 and R3. These are levels which when approached signal potential reversals. So when price is approaching and tests the S3 level below the buffer zone, a reversal to the upside may be on the horizon. In other words a reversal from a bearish trend to a bullish trend in that timeframe. Equally, when price is approaching and testing the R3 level above the buffer zone, then a reversal is possible with the bullish price action reversing to bearish. In both cases the next level then denotes the level for the stop loss. For a reversal off the S3 level higher, the stop loss could be placed at S4 and for a reversal off the R3 level, the stop loss could be placed at the R4 level – assuming these levels fit your risk and money management rules.

The potential price targets are then as follows:

For an R3 reversal the profit targets are from S1 to S3.

For an S3 reversal the profit targets are from R1 to R3.

Breakout Trading

For breakout trading the key levels are the R4 above the buffer zone and the S4 below. These are levels at which the price is expected to breakout from the current region and develop a strong move away from the region. So any move to test and break the R4 level is likely to see price continue higher and develop a strong trend. Equally if the S4 level is tested, then price is likely to continue lower and develop a strong trend.

For an S4 breakout the profit targets are S5 to S6

For an R4 breakout the profit targets are R5 to R6

Using the Camarilla levels in this way offers a complete solution to two distinct approaches to trading, and in addition, also provide potential target levels along with suggested stop loss positions, but as always these must meet your risk and money management rules.

And it is important to understand the indicator and associated levels can be adopted in two very distinct ways.

First, if you are more suited to mechanical trading where you feel more comfortable with a rule set, then the levels can be considered as your rule set. However, if you are more suited to discretionary trading then the indicator is a perfect complement to other Quantum indicators such as the support and resistance indicator, which again is one based purely on price, and so helps to reinforce levels delivered by the Camarilla protocol. Other indicators such as the Trend Monitor also work perfectly in association with this indicator.

The Camarilla levels indicator works in all timeframes on both standard and custom charts, and in every market, so can be used to trade stocks, commodities, forex or indices on the NinjaTrader platform.

So whether you’re a discretionary trader who prefers swing trading, or a breakout trader who is more systematic, the Camarilla levels indicator can deliver it all.

To help you when using the indicator we have also included some simple messages to guide you as the various levels are approached and tested. These appear as follows :

- If the current open price is between R3 and S3 the indicator displays the words – Possible mean reversal trade is on the horizon

- If the current open price is between S3 and S2 the indicator displays the words – Possible long position now on the horizon

- If the current open price is between R3 and R2 the indicator displays the words – Possible short position now on the horizon

- If the current open price is between R3 and R4 the indicator displays the words – Possible breakout now on the horizon for a long position

- If the current open price is between S3 and S4 the indicator displays the words – Possible breakout now on the horizon for a short position

When there is nothing of interest, the indicator displays the message – Analysing the chart…

You can of course elect to switch these messages off, and they are only included to alert you to possible set ups occurring.

Installation

Open your NinjaTrader platform and select a chart

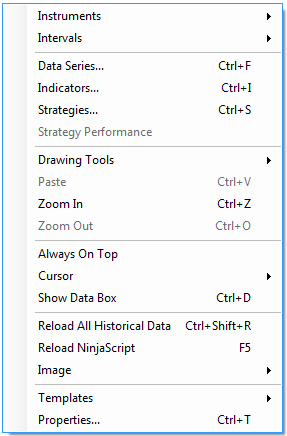

- Right click – this will open the following window:

- Left click > Indicators

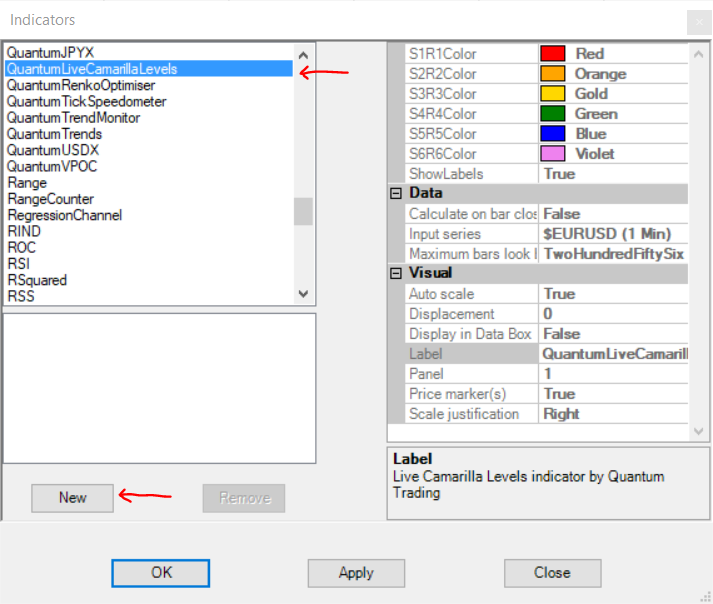

This will open the following window: (you can also open this window in another way by clicking on the Indicators icon in the NinjaTrader toolbar)

Scroll down to the QuantumLiveCamarillaLevels indicator:

- Left click > This will highlight the indicator in blue

- Left click > ‘New’ button as shown above

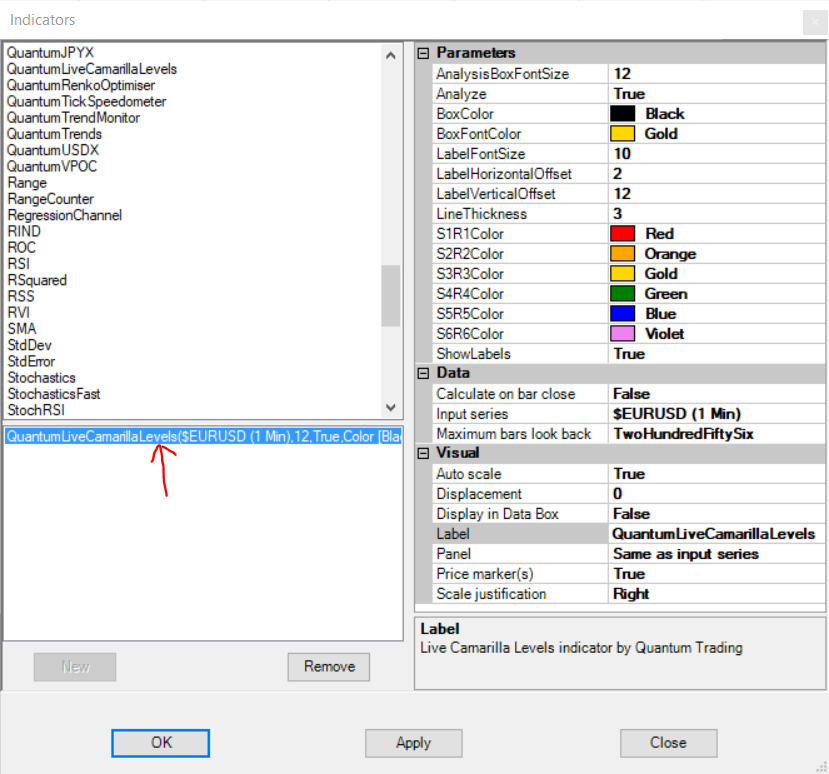

This will add the QuantumLiveCamarillaLevels indicator in the box below as shown here:

Before clicking the OK or Apply button to complete, the indicator has one or two options which can be configured. You can click the Apply button at any time, and this will apply any changes you have made to the indicator, without closing the window. This will allow you to see the changes you have made, and to modify again before closing with the OK button, or the Close button. All of the user configuration is done on the right hand side of the above screen, which is shown enlarged below. These are the default settings when you first install the indicator to a chart.

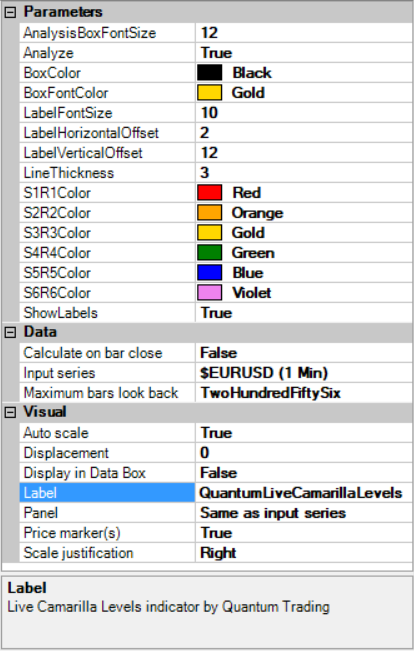

Parameters

Analyze – Quantum Live Camarilla Levels constantly analyzes price movement and displays it as a message in a box located at the top left corner of the chart. If you prefer to turn off this feature, you can un-tick this property to hide the box.

ShowLabels – To help you identify which level is which we have added labels just at the end of each line. You can hide these labels by un-ticking this property.

LineThickness – You can increase or decrease the thickness of all the lines by changing this field’s value in the range of 1 to 5. The default thickness is set to 3.

LabelHorizontalOffset – You can adjust the value of this property to move the line label horizontally. Increasing its value moves the label to the left and decreasing it moves the label to the right. Its default value is set to 2.

LabelVerticalOffset – You can adjust the value of this property to move the line label vertically. Increasing its value moves the label upwards and decreasing it moves the label downwards. Its default value is set to 12.

LabelFontSize – This property defines the font size of the line labels. It is set to 12 by default.

AnalysisBoxFontSize – This property defines the font size of the text in the Analysis Box. It is set to 12 by default.

S1R1Color – This field defines the color of the Level 1 Camarilla levels: R1 (Resistance 1) Line and S1 (Support 1) Line. By clicking the value of the this field, a drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default color of Level 1 lines is Red.

S2R2Color – This field defines the color of the Level 2 Camarilla levels: R2 (Resistance 2) Line and S2 (Support 2) Line. By clicking the value of this field, a drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default color of Level 2 lines is Orange.

S3R3Color – This field defines the color of the Level 3 Camarilla levels: R3 (Resistance 3) Line and S3 (Support 3) Line. By clicking the value of this field, a drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default color of Level 3 lines is Gold.

S4R4Color – This field defines the color of the Level 4 Camarilla levels: R4 (Resistance 4) Line and S4 (Support 4) Line. By clicking the value of this field, a drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default color of Level 4 lines is Green.

S5R5Color – This field defines the color of the Level 5 Camarilla levels: R5 (Resistance 5) Line and S5 (Support 5) Line. By clicking the value of this field, a drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default color of Level 5 lines is Blue.

S6R6Color – This field defines the color of the Level 6 Camarilla levels: R6 (Resistance 6) Line and S6 (Support 6) Line. By clicking the value of this field, a drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default color of Level 6 lines is Violet.

BoxColor – The color of the box where the analysis messages appear can also be customized. Very much like the Level Line Colors, you can change it by clicking the value of this field. A drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default background color is Black.

BoxFontColor – The color of the analysis messages itself can be customized as well. Very much like the Level Line Colors, you can change it by clicking the value of this field. A drop down box will appear that allows you to choose a different color in a variety of swatches available in NinjaTrader. The default background color is Gold.

Data

These are the Data inputs:

Calculate on bar close – please DO NOT change this setting and leave as the default of False Input series – this shows the timeframe for the indicator and will be displayed according to the chart time. In this case the indicator was attached to a EURUSD 5min chart

Maximum bars look back – this is the maximum number of bars in the look back for the indicator. We suggest you leave this as the default of TwoHundredFiftySix as it is memory friendly

Visual

These are the Visual inputs:

Auto Scale – DO NOT change this setting and leave this as the default of True

Displacement – DO NOT change this setting and leave this at the default of 0

Display in Data Box – we suggest you leave this at the default of False

Label – this is the label which will display on the chart once the indicator is attached. You can remove this if you wish as follows:

- Place your mouse on the Label label, and left click. This will highlight Label in blue. Left click in the value field alongside and your cursor will appear. Delete the text using the back button and when you apply the indicator, the text will no longer be displayed

Panel – please DO NOT alter this setting

Price Marker(s) – please DO NOT alter this setting and leave as the default of True Scale

Justification – please DO NOT alter this setting and leave as the default of Right

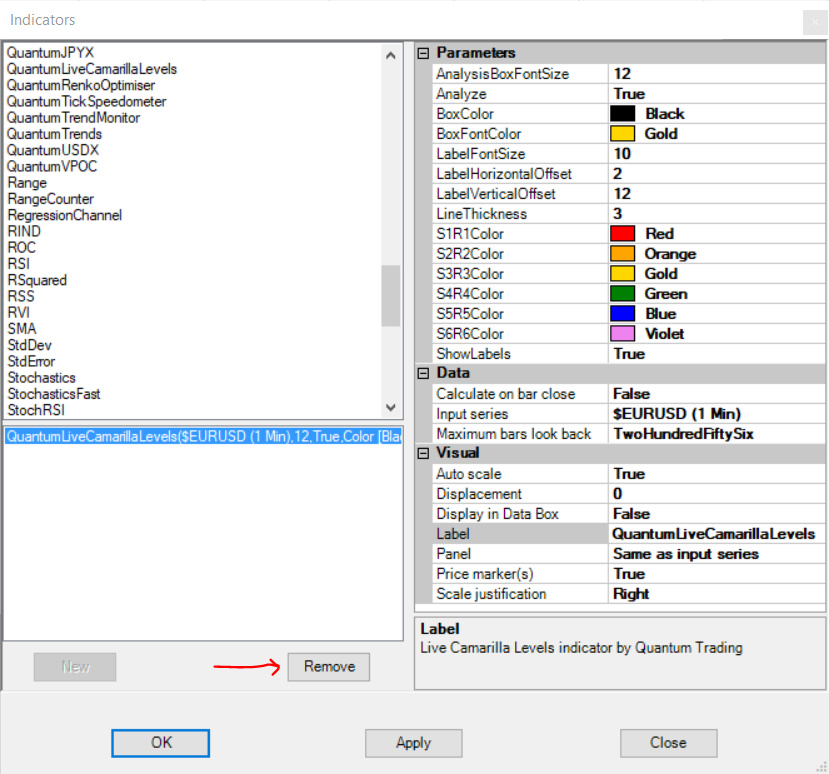

Removing an indicator

These are the steps to remove an indicator from a chart: Right click on the chart and then left click on Indicators from the pop up menu. Scroll down to the indicator you wish to remove and left click which will turn the indicator blue. This will then display the indicator window with its settings as shown below:

Simply left click on the Remove button as shown above, and the indicator will disappear from the list of indicators on the chart. To confirm left click the OK button to confirm and close the window.

Simply left click on the Remove button as shown above, and the indicator will disappear from the list of indicators on the chart. To confirm left click the OK button to confirm and close the window.